How to track the cost of doing business – for new and established organizations.

-

Industry: Technology products and services

-

Size: $5M, 40 employees

-

Years in business: 20

For small to medium-sized businesses and even larger organizations – getting your arms around operating costs can be challenging. Oftentimes entrepreneurs launch successful companies and operate for months or years, in the case I’m referencing, decades realizing day-to-day operational success and year over year profits – without having a real idea of operating costs. My client here is a twenty-year-old business that is successful by all measures but didn’t take the time to track operating costs. And after all those years, where do you even begin?

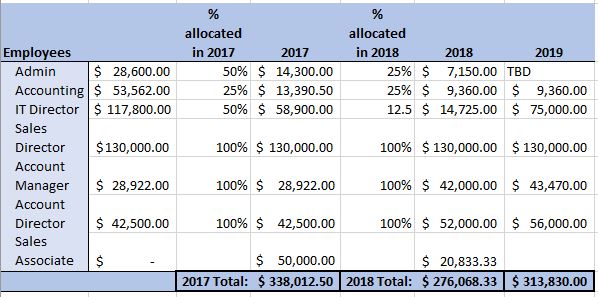

I recommend baby steps in cases like these. Start with your employees, this should be data that is relatively easy to access. Be sure to factor in base pay, overtime, commissions, bonuses, and benefits. If your benefit information poses a challenge just start with base, overtime, commissions, and bonuses.

Depending on when you decide to tackle this project, it may be easier to work with last year’s numbers. Once you outline last year’s costs, you’ll have a template for inserting this year’s data and you can keep a living document updated year to year to track your operating costs. Ideally, you will want to keep track of trends and adjust accordingly…but that’s a whole other project and the topic for another post.

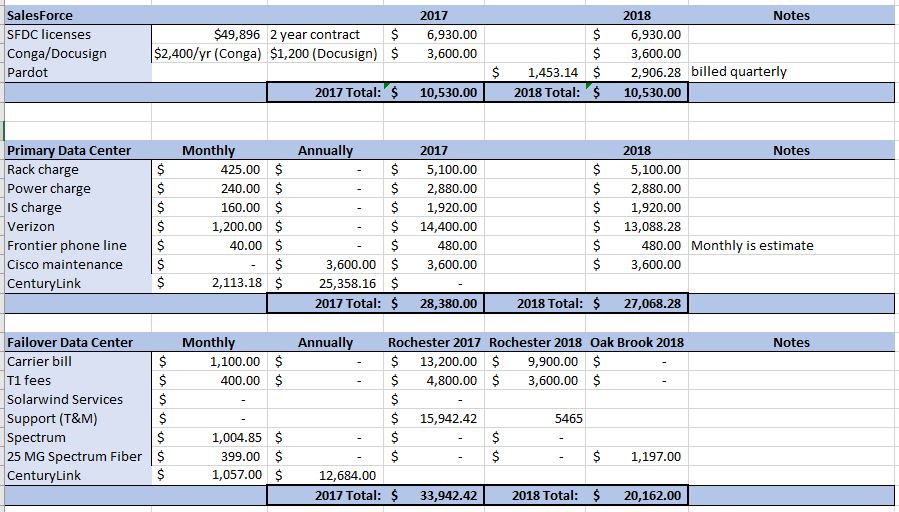

Once you’ve completed your staffing costs, start gathering your infrastructure costs. For some business owners, this is relatively simple as you probably have a dedicated account for paying bills and a line of credit that is specifically for business expenses. For more complex organizations, like the one I was working with, you may have to account for multiple divisions with different decision-makers signing contracts and paying for things. If you’re able to pull your management team together to account for their monthly and annual expenses, do that! This by no means needs to be a single-person project.

Try not to fixate on finding every single expense and calculating the monthly or annual cost down to the penny. Also, try not to get hung up on fixed versus variable costs. If you feel it’s important to account for the monthly cost of each infrastructure item it’s best to total up your annual cost and plug in your “monthly average”. Be sure to notate it in your budget document as a variable cost instead of a fixed cost.

Again, depending on your line of business you may need to account for product costs or license fees. The organization I’m referencing here is in the technology industry, so software license fees were a big consideration, for the organization’s internal use and for re-selling to customers. Depending on the size of your business it may be easier to omit products or services you are re-selling to clients from your operating costs. You can account for those separately in a sales revenue-style report. This is often easier and a more elegant way of accounting for those costs.

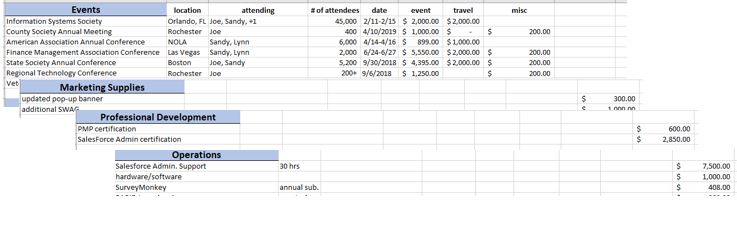

Finally, I recommend accounting for your marketing costs. The organization I was working with did not formalize a marketing budget, so we started with tracking the cost of trade show materials, including some SWAG items and we ended up creating a separate marketing budget that outlined each trade show, travel expenses, cost of lodging, and so on. We also earmarked some funds for website development based on the cost of updates that were completed the previous year. This marketing budget became a detailed spreadsheet to be maintained as a separate component of the master operating budget.

*details modified for privacy

As you work through this process, I recommend keeping it simple. Even if you start with a two-column spreadsheet that includes expense descriptions and amounts, remember this is progress – you can flesh it out in time, what’s important is that you’ve started. If the whole thing seems daunting or beyond you, recruit assistance. If you invest in completing this project one time, in detail, it will be significantly easier year over year to track your expenses.

Here are some important considerations as you reflect on your numbers:

- Are there expenses you had no idea existed? Did any of the costs come as a complete surprise? If so, it’s important to understand why.

- Is there an opportunity to implement some processes for accounting for operating costs? If your department directors aren’t reviewing and approving monthly expense reports for their team, they should be. In smaller organizations, you can have a single point of contact for review and approval.

- Where are the opportunities to reduce costs? After completing this project with my client we were able to create 13% cost reduction, just by becoming aware of the costs, renegotiating contracts, and eliminating waste.

- And finally, the BIG question – what is your profit margin? Is it more or less than you thought?